Deciding how customers can pay on your online store is a big deal. It’s like the final battle in getting that order through! If you’re not offering quick, easy, and safe payment options, you might miss out on sales. And if you’re shopping around for choices, chances are you have heard of Shopify and PayPal.

Shopify is a huge platform for ecommerce and has its own payment system, Shopify Payments. But PayPal has been around forever and is super trustworthy. So, which one should you go for?

We’ll break down all the important aspects about Shopify and PayPal in this guide, so you can pick what works best for you.

Shopify Payments Overview

Shopify, a super popular e-commerce platform worldwide, keeps getting better with new features, notably Shopify Payments, a cool PayPal alternative. This payment system is a hit in the United States and 23 other countries where it’s available. Designed just for Shopify stores, Shopify Payments makes it easy for sellers to accept different payment methods, keeping transactions safe and managing finances hassle-free. Plus, its simple interface means quicker payouts, making shopping smoother for both buyers and sellers.

Shopify Payments Pros

Shopify Payments offers a host of benefits that make it a standout choice for Shopify store owners:

- Its integration into the platform is seamless and swift, requiring minimal setup time. Additionally, the platform facilitates quick payouts, with profits typically transferred to the merchant’s bank account within just three business days, much faster than other payment platforms.

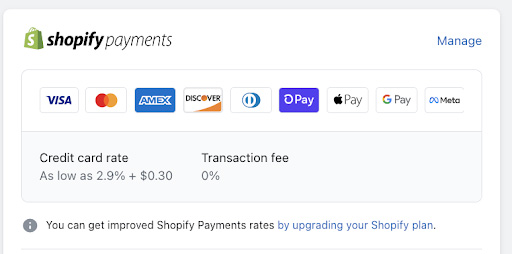

- By eliminating the need for third-party payment platforms, Shopify Payments helps online store owners easily accept credit cards and other payment methods with low fees. With Shopify Payments, you can accept payments directly from your customers by: Visa, Mastercard, Apple Pay, Google Pay and Amex.

- Shopify Payments enables businesses to accept international payments, expanding their reach to a global audience.

- It provides access to comprehensive analytics and business management solutions, offering valuable insights into sales, payments, pending transactions, and Shopify fees. These analytics empower merchants to make informed, data-driven decisions to drive the growth and success of their businesses.

Shopify Payments Cons

While Shopify Payments offers convenience, there are some drawbacks to consider:

- Customers may hesitate to input sensitive credit card information directly on your Shopify store’s checkout page, potentially leading to lost sales from those who prefer the security of a third-party platform.

- This payment option is exclusively for businesses using Shopify, limiting accessibility for those not on the platform or considering a future switch.

- As Shopify Payments is currently accessible in only 23 countries, which may restrict international business expansion for some merchants.

| Pros ✅ | Cons ❌ |

|---|---|

| Integrates into the platform, offering swift setup and quick payouts within three business days | Some customers may avoid inputting credit card details on Shopify’s checkout, possibly resulting in lost sales |

| Streamlines payment processing and direct payment with minimal fees | Restricted to Shopify users, limiting access for businesses not on the platform |

| Accepts international payments | Currently available in only 23 countries |

| Offers detailed analytics for informed decision-making and business growth |

PayPal Overview

PayPal is an online payment platform that allows individuals and businesses to send and receive money electronically by linking their bank accounts and credit cards to an account. With around 426 million global users across more than 202 countries and regions, and a large number of ecommerce platforms integrating with PayPal, it’s a trusted and widely-used payment method.

You might wonder, “Can I use PayPal with Shopify?” Yes, you can! It’s simple to connect PayPal to your Shopify store, and when customers see the “Pay with PayPal” option, they can pay easily. Offering PayPal can encourage more customers to buy from your store!

PayPal Pros

- Many online shoppers trust PayPal for safe payments, thanks to its long-standing reputation and Protection Programs for both Seller and Buyer.

- Because lots of people already have their payment details saved on PayPal, it’s easier for them to buy from your store, eliminating the need to switch to other payment methods.

- PayPal works with many online store platforms, accepts payments from around the globe, and doesn’t require contracts. You only pay fees when customers use PayPal to buy from you.

PayPal Cons

- Using PayPal means customers have to go to another webpage to finish their payment, which disrupts the buying experience and can be annoying.

- PayPal’s fees are high and can eat into your profits.

| Pros ✅ | Cons ❌ |

|---|---|

| Millions of online shoppers use PayPal | Inconvenient paying experience for customers |

| Saved information on PayPal obviates the need for other payment methods | Fees may be high for store owners |

| Accepts international payments and Integrated into many platforms | |

| No contracts – you only pay fees when customers proceed with PayPa |

Shopify Payments vs PayPal: A Comparison

A Quick Comparison

Let’s focus on what matters most to business owners when comparing payment processors. That’s why we chose these features to evaluate these two payment providers, provided in this table:

| Features | Shopify Payments | PayPal |

|---|---|---|

| Costs and Fees | 2.4% – 2.9% + 30 cents per transaction | Within the US, 2.9% + $0.30 Outside the US, 4.39% + fixed fees based on the country’s currency received |

| Payment Procedure | Seamless integration for easy installation and use | Time-consuming and disruptive |

| Payout Schedule | 3 business days | 5-7 business days |

| Dispute Resolution and Chargeback | Within 60 days and $15 chargeback fees | 75 days and $20 chargeback fees |

| Security | PCI-compliance | PCI-compliance |

| Customer Support | 24/7 support | 24/7 support |

Costs and Fees

With Shopify Payments, there’s no transaction fee, but you’ll pay credit card fees based on your plan (ranging from 2.4% to 2.9% + 30 cents per transaction). It’s cheaper because you don’t need an extra payment provider.

PayPal charges higher fees because it’s a third-party service.

In the US, you pay 2.9% of the transaction amount plus a $0.30 fee.

For payments outside the US, it’s 4.39% plus a fixed foreign exchange fee.

Overall, Shopify Payments saves you money, with transaction fees 0.5% to 2% lower than PayPal.

Payment Procedure

Shopify Payments is super easy to use and set up. How easy is it?

- Step 1: Check Your Eligibility

Before diving into Shopify Payments, ensure it’s available in your country and supports your business type by reviewing Shopify Payments’ Terms of Service.

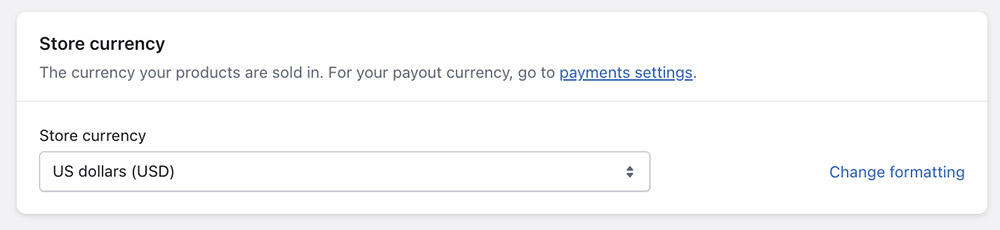

- Step 2: Set Your Store Currency

Once eligible, select your store’s currency under Settings > Store details. Choose your preferred currency and Save.

Changing currency after your first sale requires assistance from Shopify.

Keep in mind that Shopify Payments is available in specific countries, so only certain bank account currencies are supported to enable Shopify Payments.

After selecting your currency, you can proceed to activate Shopify Payments.

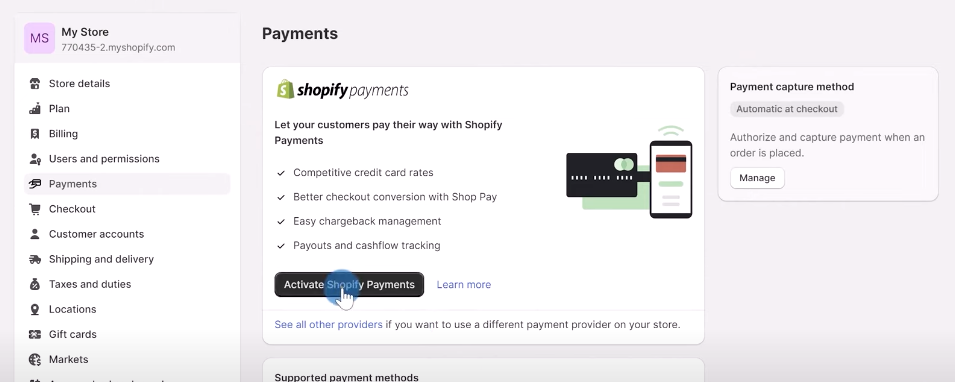

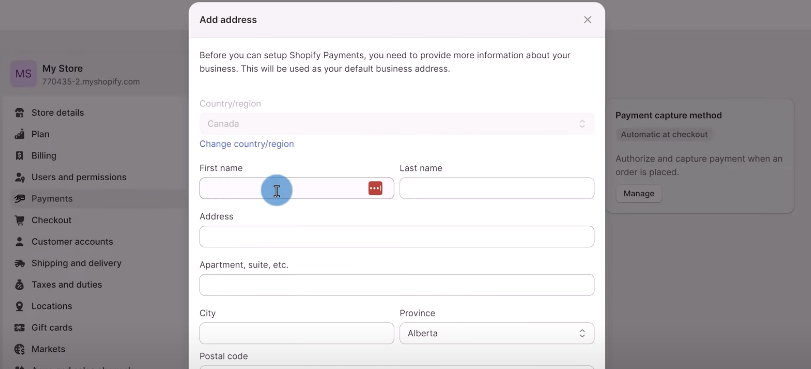

- Step 3: Activate Shopify Payments

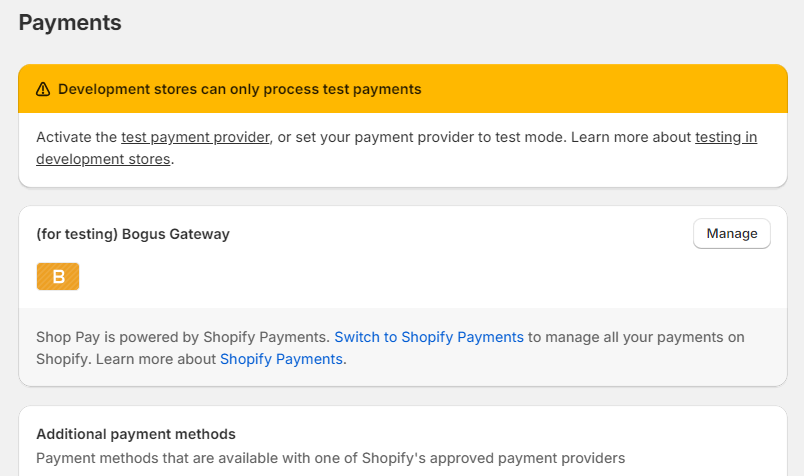

In your Shopify admin, navigate to Settings > Payments. There are two ways to activate Shopify Payments:

1. Complete account setup if no other credit card provider is set up.

2. If you want to transition to Shopify Payments from another provider, locate your current provider at the top of the Payments section. Beneath it, you’ll find an option to Switch to Shopify Payments.

Then click Activate Shopify Payments in the Shopify Payments box.

- Step 4: Input your store details

If eligible, a Shopify Balance account is generated, or else you need to provide your banking information.

Depending on your region or eligibility, activate two-step authentication for added security.

- Step 5: Click Save.

Depending on where you are, you might need to tweak some settings or add your info, but it’s pretty straightforward. Customers love how smooth it is to enter their card details and buy stuff right on the browser.

But with PayPal installation, your customers get redirected to another site to pay, which annoys your customers and possibly reduces your conversion rate.

Payout Schedule

With Shopify, you’ll get your money in about three days. Customers paying with Shopify Pay will see almost instant transactions, but others, who don’t have an account, might take a bit longer to enter their payment info.

With PayPal, payouts take about five to seven days. Customers using PayPal Express Checkout will pay quickly, but others might take a tad longer to log in and choose their payment method.

Dispute Resolution and Chargeback

With Shopify Payments, disputes might take within 60 days to be resolved, and they’ll cost the store owner $15, no matter who’s at fault. The store owner and the customer will need to provide proof.

If the customer wins, Shopify refunds him or her. If the store owner wins, Shopify refunds the dispute fee.

In the event of excessive disputes, Shopify retains the authority to restrict your platform access.

For PayPal, disputes can also take up to 75 days and cost you $20 for a chargeback. Both the store owner and the customer have 10 days to provide evidence. While PayPal investigates, the disputed funds stay frozen in your account.

If your business account on PayPal gets a lot of chargebacks, your account might be locked.

Security

Shopify Payments provides several security features to ensure safe transactions for both you and your customers, including:

- PCI-compliance: Shopify Payments is PCI DSS compliant, meaning it meets the Payment Card Industry Data Security Standard, ensuring that sensitive payment information is securely processed, transmitted, and stored.

- Fraud Analysis: There are built-in fraud analysis tools in Shopify that automatically flag potentially fraudulent transactions and orders, helping merchants identify and prevent fraud.

- SSL Encryption: Shopify encrypts all data transmitted between the customer’s browser and the Shopify servers using Secure Sockets Layer (SSL) technology, ensuring that sensitive information, such as credit card details, remains secure.

Alternatively, PayPal stands as a reliable and secure avenue for processing payments on your site, offering robust measures to safeguard both your and your customers’ data.

- Buyer and Seller Protection: PayPal offers both buyer and seller protection programs, which help resolve disputes and provide reimbursement in case of unauthorized transactions, fraud, or items not received.

- PCI-compliance: PayPal complies with the PCI DSS’s standards.

- Encryption and Fraud Detection: PayPal ensures data security through industry-standard encryption and employs advanced algorithms to detect and prevent fraudulent activities, protecting users’ financial details and transactions.

Customer Support

Both PayPal and Shopify offer comprehensive customer support features, including live chat, email support, user forums, 24/7 support and extensive knowledge bases to assist users with any issues or inquiries they may have regarding their services.

Conclusion: Shopify Payments vs PayPal – So Which Is Better?

Shopify Payments and PayPal are both popular payment options for online businesses. They differ in transaction fees, payout procedure and schedule, and dispute resolution.

While Shopify Payments is designed for Shopify users, PayPal is more widely accepted across eCommerce platforms.

The good news is, as a Shopify owner, you can use both!

Offering multiple payment options reduces barriers for customers to proceed with payout and builds better relationships.

How to Add PayPal to Shopify?

If you’re thinking about linking PayPal to your Shopify store, it’s quite straightforward.

Just make sure your Shopify and PayPal accounts use the same email address. Then, follow these simple steps:

- Log in to your Shopify account

- From your Shopify Admin Dashboard, click on “Settings” → “Payments“

- In the “Supported payment methods”, find and select “PayPal”

- Click “Activate”

- Log in to PayPal and click “Grant Permission”

- Click “Save” in Shopify

You’re all set! Your PayPal and Shopify accounts are now connected.

FAQs

Shopify Payments is built into Shopify for sellers, offering various payment providers, whereas PayPal is a third-party payment platform which can be added as an extra payment choice.

While both options offer security features like encryption and fraud detection, PayPal may have a broader range of security tools and services due to its specialization in online payments.

While PayPal suits many small businesses, it might not be the cheapest option for high-volume or riskier sales. Contact PayPal to check if you qualify for lower rates, especially for bigger sales.